Teambuild Consultancy helped a national mortgage broker based in the United Kingdom achieve impressive business growth over a three-year period. The growth occurred over a three-year period. By partnering with Teambuild, the client was able to increase their mortgage lending by 120% and expand their market share.

This case study outlines how Teambuild provided strategic guidance. They also implemented solutions that enabled the client to improve operations. They increased productivity and delivered an enhanced customer experience.

Teambuild’s expertise transformed the mortgage broker’s performance. It solidified the broker’s position as one of the top in the industry. Teambuild has a keen understanding of the client’s objectives.

Let’s take a detail look at the clients detail and requirement

The Client

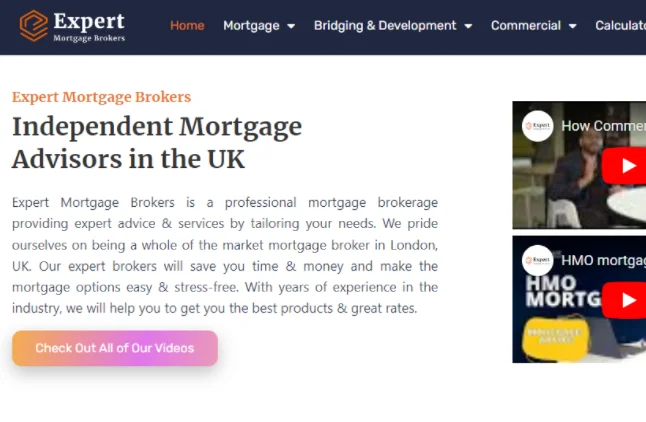

The client is one of the leading mortgage brokers in the United Kingdom. The company is headquartered in London. It has been operating for over 15 years. Director Jahed Mirza leads the company.

They specialise in providing an extensive range of mortgage products to suit the needs of a diverse customer base. Their offerings cover everything from traditional loans like conventional and government-backed mortgages. They also offer more specialized products like portfolio, and bank statement loans.

The client aims to make financing property purchases straightforward and accessible. They focus on flexibility and customisation. Over the years, they have built a reputation for their exemplary customer service and transparent processes.

Yet, by 2018 the client wanted to expand their operations and reach to achieve their ambitious growth objectives. This led them to seek out a reliable outsourcing partner.

The Requirement

They needed a business process outsourcing solution to transform operations. The goals were to maximise productivity, speed up cycles, and support growth. A tailored BPO partnership would integrate expert admins into workflows. This would free up staff for high-value tasks. It would also add capacity to handle increased volume.

The client required a partner to streamline mortgage processing. This would enable excellent customer service as they captured more market share.

Core Areas of Collaboration

We provided a wide range of support across Expert Mortgage Brokers’ operations:

Mortgage processing

- Reviewed disclosures against compliance checklists, ensuring the precise inclusion of all critical details.

- Examined submission documents using state-specific requirements checklists.

- Conducted audits on closed loans to ensure compliance with secondary market standards.

- Scanned new loan files, initiated required checks, and allocated processors accordingly.

- Revalidated income, employment, and appraisals in accordance with quality control protocols, and conducted random loan reviews.

- Facilitated funding processes by meticulously reviewing details such as types, sources, and fees.

- Verified all documents against pre-purchase checklists prior to acquisition and cleared underwriting conditions.

- Prepared completed wholesale loans for the onshore team.

Call center

- Gave virtual assistance to all branches.

- Scheduled appraisals. Updated appraisers on status.

- Qualified and transferred leads to loan officers.

IT & accounting

- Provided Encompass and tech support.

- Maintained books of accounts.

By handling critical mortgage tasks, we enabled Expert Brokers to boost productivity. Our tailored services let them focus on business growth and customer service.

The Challenges

With Expert Mortgage Brokers’ rapid growth, admin workloads were overwhelming internal teams. Loan volumes outpaced capacity, slowing turnarounds.

Key challenges included:

- High volumes demanded efficient, flexible operating models.

- Complex loans needed special handling by experts.

- Multiple departments required coordination for smooth workflows.

There was a clear need for strategic support to lift productivity and quality.

Recommended read:

The Solution

We rapidly deployed a 60+ person team trained in mortgage operations. Within 90 days, we were handling critical work across departments.

Our approach:

- Created standardized protocols while allowing flexibility where needed.

- Established a specialized queue for complex loans staffed by senior experts.

- Supported sales, underwriting, post-closing, and other units to maximize efficiency.

- Enabled faster, higher-quality loan processing through end-to-end capabilities.

With tailored BPO services, we empowered Expert Brokers to meet demand and accelerate growth. Our mortgage operations expertise drove productivity gains across the business.

What Business Impacts We Delivered

By partnering with us, Expert Mortgage Brokers achieved:

- 50% reduction in costs for tasks moved from internal staff to our efficient BPO team.

- 15-20% savings on work transitioned from their previous outsourcing provider.

- 30% faster processing and underwriting through our expertise.

- 140% business growth over 4 years – they funded over £8 billion last year!

Recommended read:

Our tailored mortgage processing services enabled Expert Mortgage Brokers to:

- Save significantly on operations costs.

- Accelerate turnaround times.

- Scale efficiently as volumes surged.

- Focus internally on strategy and growth.

Jahed Explains the impact of our mortgage processing services:

“Teambuild turbocharged our mortgage operations. Their expertise seriously pumped up productivity by 50% so we could meet surging demand. By taking on critical tasks, Teambuild gave my team the bandwidth to focus on growth. Now we’re closing loans 30% faster thanks to Teambuild’s know-how. With their help, we’ve grown our business a massive 140% in just a few years. Teambuild’s tailor-made solutions have been a total game-changer for scaling our operations. Their partnership has transformed our capacity big time.”

Jahed Mirza, Director at Expert Mortgage Brokers

Recommended read:

The Final Outcome

Our tailored BPO solution delivered transformative results:

- Enhanced flexibility and scalability enabled Expert Brokers to meet surging demand.

- Mortgage operations expertise boosted productivity and efficiency.

- Handling critical tasks reduced attrition among sales and operations staff.

- The value of our partnership was evident within the first 60 days.

- Expert Brokers steadily expanded the scope of our collaboration.

In Jahed’s words:

“When we have an operational challenge, Teambuild is always the first solution we consider.”

By leveraging our mortgage operations mastery, Expert Brokers empowered their impressive growth. Our strategic support allowed them to scale efficiently, improve quality, and focus on customer service. This high-impact partnership continues to enhance Expert Brokers’ productivity and position them for future success.