Mortgage processing is essential for timely loan approvals and smooth transactions. Brokers must choose between in-house processing or outsourcing to a provider.

Outsourcing leverages automation and offshore labour to reduce costs and drive efficiency. However, in-house processing allows for greater oversight and control.

This article weighs the pros and cons of each approach. Key factors include cost, speed, quality, and managing fluctuating volumes.

Understanding these tradeoffs allows brokers to optimise operations. The right processing solution depends on their strategic objectives, resources, and risk tolerance. With an informed strategy, brokers can improve productivity and the borrower experience.

In-House Mortgage Processing

In-house mortgage processing refers to the practice of handling all aspects of mortgage processing within the organisation itself. This approach offers several advantages, such as greater control over the process and the ability to customise the workflow to meet specific requirements.

The in-house team has a deep understanding of the organisation’s policies and procedures, enabling them to provide a more personalised experience to borrowers. Additionally, the team can quickly address any issues or delays that may arise during the processing stage, ensuring a smoother and faster mortgage approval process.

Advantages of in-house mortgage processing

In-house mortgage processing offers several advantages for mortgage brokers:

- Greater control: With in-house processing, brokers have full control over the entire mortgage process, from start to finish. They can customise the workflow to meet specific requirements and ensure compliance with company policies and procedures.

- Personalised experience: The in-house team has a deep understanding of the organisation’s policies and can provide a more customised experience to borrowers. This leads to better communication, faster response times, and improved customer satisfaction.

- Faster problem resolution: In-house teams are closer to the mortgage files and can quickly address any issues or delays that may arise during the processing stage. This ensures a smoother and faster mortgage approval process, reducing the risk of losing potential borrowers.

Disadvantages of in-house mortgage processing

While there are several advantages to in-house mortgage processing, there are also some disadvantages to consider. These include:

- Increased operational costs: Setting up an in-house mortgage processing department can be costly, requiring investments in technology, software, and personnel.

- Limited scalability: In-house teams have a finite capacity, which can be a challenge during times of high mortgage demand. Scaling up the team may require additional resources and time.

- Lack of specialisation: In-house teams may have a different level of expertise or specialised knowledge than outsourced mortgage processors who focus solely on this area.

- Compliance and regulatory risk: In-house processing requires staying up-to-date with changing regulations, which can be time-consuming and increase the risk of errors or compliance issues.

- Difficulty in managing fluctuations: In-house processing may need help to handle sudden spikes or dips in mortgage applications, leading to capacity constraints or underutilised resources.

By considering these disadvantages, mortgage brokers can make an informed decision on whether to pursue in-house processing or explore outsourced options.

Outsourced Mortgage Processing

Outsourced mortgage processing involves partnering with a third-party company that specializes in handling mortgage-related tasks. This approach offers several advantages. Firstly, Mortgage Brokers can access a team of experienced professionals who are well-versed in mortgage processing, ensuring efficiency and accuracy.

Additionally, outsourcing allows for scalability, as the third-party vendor can quickly adjust their resources to handle fluctuations in mortgage volume. It also reduces operational costs, as lenders do not need to invest in hiring and training their in-house team.

However, there are also some potential drawbacks, such as security concerns and communication challenges, that should be considered before deciding to outsource mortgage processing.

Advantages of outsourced mortgage processing

- Access to specialized mortgage processing experts rather than needing in-house staff.

- Scalability to handle changing volumes without overstaffing.

- Faster processing times through provider automation and systems.

- Cost savings from avoiding set-up and overhead of in-house processing.

- Allows focus on core broker tasks like finding deals and borrowers.

- Can leverage global expertise by offshoring to qualified partners.

Disadvantages of outsourced mortgage processing

- Less control and visibility over day-to-day processing operations.

- Security and privacy risks if the vendor lacks proper protections.

- Potential communication gaps or delays in coordinating with external partners.

- Over reliance on vendors makes it difficult to bring the process back in-house.

- Still need in-house quality control and due diligence on providers.

- Contract terms like pricing must be optimized to realize full benefits.

The key for brokers is finding the right partner to maximize advantages while minimizing risks. With robust oversight and the right provider, outsourcing can significantly benefit mortgage brokers.

Recommended read:

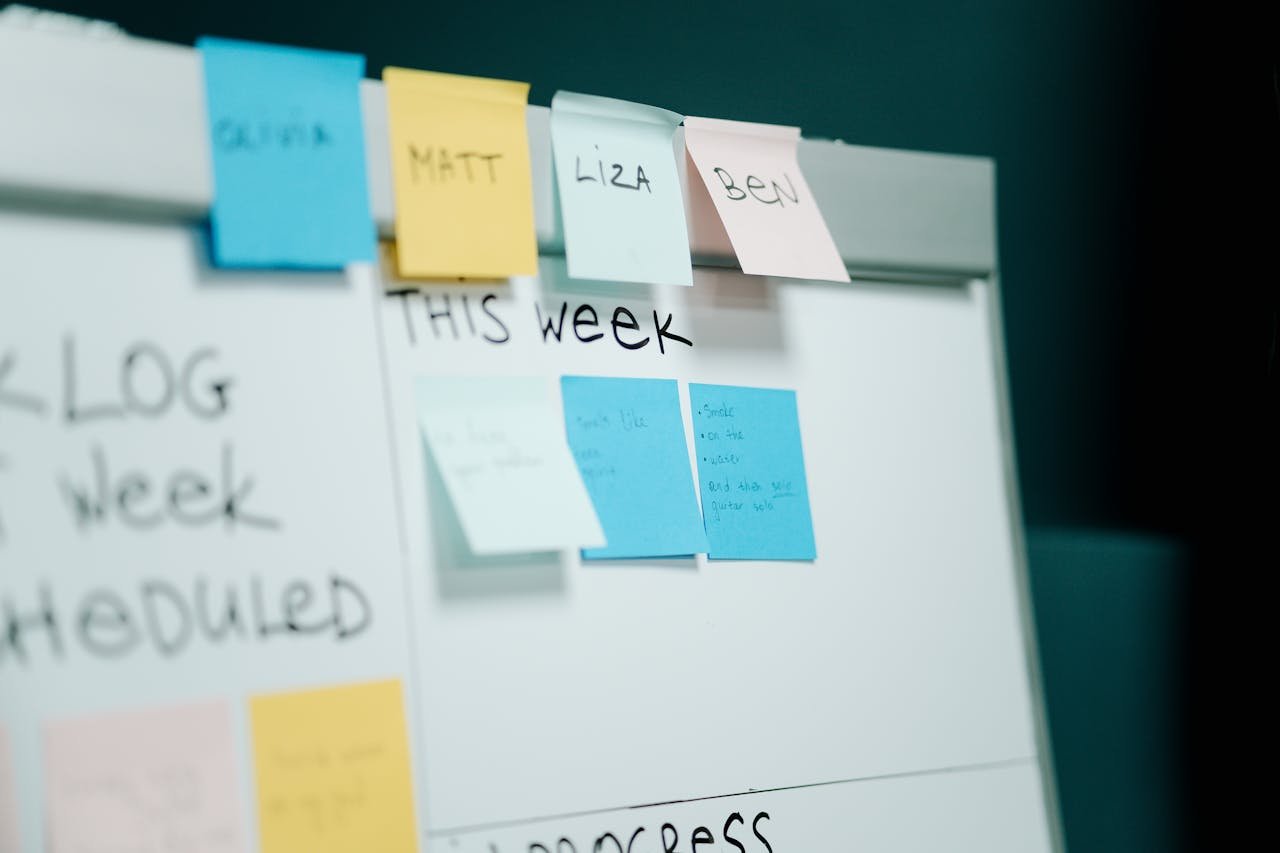

Recommendations for Mortgage Brokers

Based on the analysis of in-house vs outsourced mortgage processing, here are some recommendations for mortgage Brokers:

- Evaluate the volume of mortgage applications and determine if in-house or outsourced processing is more suitable for your needs.

- Consider the level of control and customization required for your mortgage processing operations.

- Conduct a cost analysis to determine if in-house processing can provide cost savings or if outsourced processing offers better cost efficiencies.

- Assess the expertise and resources available within your organization to handle mortgage processing in-house.

- Prioritize data security and choose a trusted outsourced partner with robust security measures in place.

- Implement quality control measures and optimize processes to ensure efficient and accurate mortgage processing.

- Regularly review and monitor the performance of your mortgage processing operations to identify areas for improvement.

By considering these recommendations, mortgage brokers can make an informed decision on whether to choose in-house or outsourced mortgage processing and ensure the success of their mortgage operations.

Recommended read:

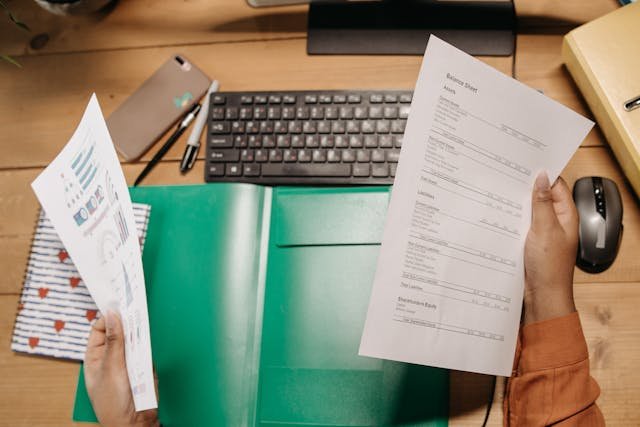

Cost Considerations

Cost is an essential factor to consider when comparing in-house and outsourced mortgage processing. In-house mortgage processing typically involves higher overhead costs, such as hiring and training staff, maintaining office space, and investing in technology and infrastructure.

On the other hand, outsourcing mortgage processing allows brokers to reduce fixed costs and pay only for the services they need. However, it’s essential to carefully evaluate the cost structure and pricing model of outsourcing vendors to ensure that the overall cost savings justify the outsourcing decision.

Cost comparison for brokers: in-house vs. Outsourced mortgage processing

When evaluating processing costs, brokers should consider:

- In-house requires staffing, office space, and tech investments. This leads to higher fixed overhead.

- Outsourcing allows brokers to pay only for services needed. This reduces fixed costs.

- But, outsourcing pricing models must be analysed to ensure actual savings. Look for economies of scale.

- Volume, complexity, turn times, and regulations also impact costs.

The optimal choice balances potential cost savings with desired control.

Outsourcing can significantly reduce brokers’ overhead if the right provider and contract terms are secured. However, thorough due diligence is required to realise the full economic benefits of an in-house team.

By weighing all factors, brokers can develop an informed processing strategy aligned with their business objectives and resources. The goal is to maximise productivity and speed while minimising variable costs.

Comparing Quality and Efficiency: In-House vs Outsourced Mortgage Processing

When evaluating options, brokers should consider the following:

- In-house allows tighter control over quality checks and standards. But, it needs more efficiency due to resource constraints.

- Outsourcing leverages providers’ expertise and tech to streamline processes. This drives greater efficiency.

- Critical to implement rigorous quality control and process optimization either way.

Regularly review workflows to identify bottlenecks. Analyze pain points through data.

Focus on continuous improvement to enhance speed without sacrificing quality.

The right solution brings together quality oversight with efficient processing. This reduces risks and costs while improving broker productivity.

By weighing choices based on their business needs, brokers can optimize quality and efficiency. The goal is faster, more compliant, and more profitable mortgage processing.

Recommended read:

Final Words

Mortgage loan processing is essential for brokers to originate and close loans efficiently. The key options each have tradeoffs:

- In-house processing allows for oversight and control but can lack scalability and the latest technology.

- Outsourcing provides expertise, faster turn times, and cost savings through offshore labour and automation.

- Hybrid models maintain core functions in-house while outsourcing specialized tasks.

No matter the approach, optimizing quality and efficiency is crucial. Regularly review processes and use data to identify improvements.

At Teambuild Consultancy, we offer the best BPO solutions for brokers. By leveraging our global expertise and advanced technology, we enable brokers to scale operations, accelerate turn times, and reduce costs. This allows brokers to focus on origination while controlling risks.

Contact us to learn more about our outsourced mortgage administration and processing services for brokers seeking to improve productivity and gain a competitive advantage.

With an optimized processing solution, brokers can close more loans faster while delivering an exceptional borrower experience.